央视少儿频道改版,8位新生代六一登场,有主持人大赛选手蔡云咏和依斯

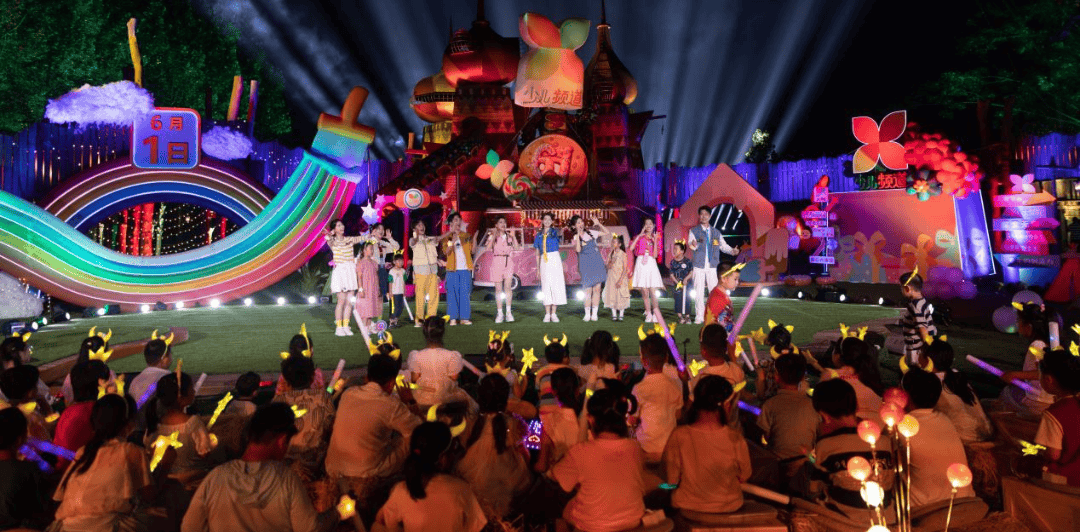

六一儿童节前夕,央视少儿频道发布2024年六一儿童节的节目编排,还官宣了8位新生代主持人,将在6月1日和2日两天的特别节目中首次集体亮相,并发布了一张8人一起表演节目的剧照。由于都是新面孔,加上镜头比较远,根本看不清谁是谁,好在还有一张新主持人与红果果在一起主持节目,看到有2023央视主持人大赛选手依斯和蔡云咏。

一次签约8位新生代主持人,不仅在央视少儿频道成立以来是第一次,包括央视所有电视频道都不多见。一方面因为第一代少儿节目主持人,现在都已经从哥哥姐姐变成了叔叔阿姨或爷爷奶奶,是时候培养新人了。另一方面随着董浩叔叔、鞠萍姐姐、金龟子的退休或退居二线,还有周洲、绿泡泡的离职,月亮姐姐常年在综艺频道,导致少儿节目主持人断层严重,补充新人迫在眉睫。

当然还有一个原因,最近央视主流电视频道都在进行大改版,每个频道都增加了年轻的新生代,比如综艺频道两周之内上了十几档新节目,还有10来位主持人大赛选手成为固定主持人,央视体育频道一档节目就上了4位新主持人。少儿频道也是借这股央视改版之风,从6月1日起开始大改版,同样将有不少精心打造的新节目和8位新主持人出现。

自从总台开始实施“干部人才队伍建设全链条机制”之后,要给年轻人信任,给年轻人机会,给年轻人兜底,多说几句“你来试试看”。整个央视都刮起了一股青春风暴,很多重要的节目都选择启用年轻主持人。同时进一步加剧了主持人内部的竞争,对于混日子的老资历主持人,哪怕工龄再长也坚决淘汰掉,有些甚至已主动离轵、转行,另寻高就。

具体到央视少儿频道,确实需要大改版和吸收新面孔了,官方统计的数据现在的电视开机不足三成,别说少儿频道,其他频道同样面临着这个问题。如今的小朋友,少儿频道已经对他们失去了吸引力,自己玩手机和平板电脑的居多。加上少儿频道没有什么能拿得出手的原创节目,小朋友更加不会看,除了上午有自己的节目,其他时间都播动画片。

希望此次大改版能真正给陷入困境的少儿频道挽回一点观众口碑,吸引越来越多的小朋友关注,在新一代小朋友的童年里留下美好回忆。同时8位新生代主持人,能抓住机会好好表现,即使不是少儿专业相关出身,也能真正做到“干一行、爱一行、专一行”,努力成为像鞠萍姐姐、小鹿姐姐、董浩叔叔、金龟子那么有知名度的少儿节目主持人。

从央视《新闻联播》首位90后主播王音棋,到央视综艺频道十几档新节目陆续出现的众多新面孔,到央视体育频道四位新人亮相,再到少儿频道启用8位新生代。充分说明央视排资论辈的时代已经一去不复返,取而代之的是对年轻人的重视,多提供机会。而有幸被重用的年轻主持人,也要主动进步,精进主持业务能力,不辜负央视给予的信任。